Key Features

Sales

Purchases

Accounts

Reports

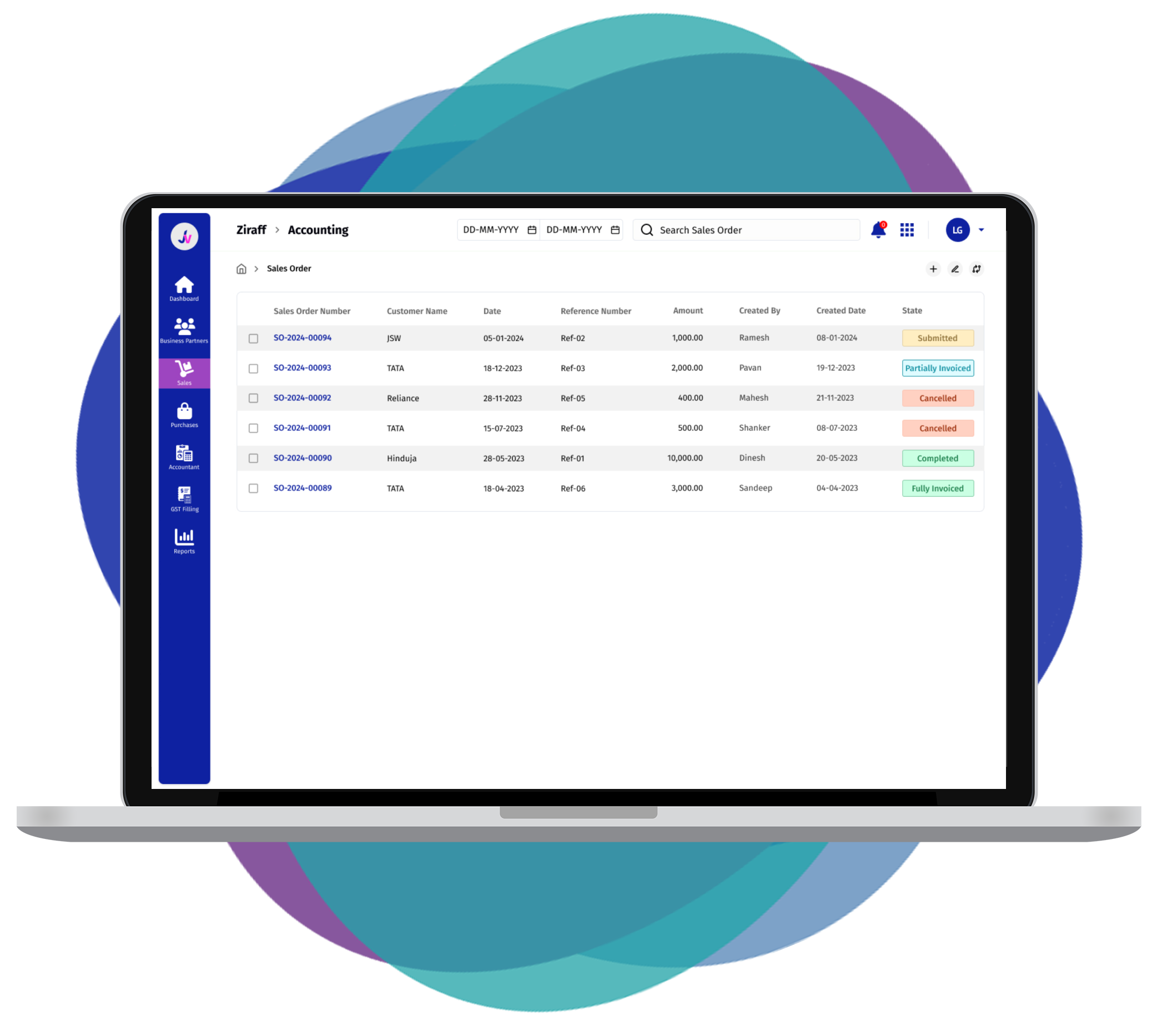

Sales

Sales are a business's engine, generating revenue from selling goods or services. A documented journey starts with a sales order. An invoice requests payment, followed by a receipt recording the settlement. Finally, a delivery challan tracks item movement, and a credit note might be issued for returns or adjustments.

Sales Order

A sales order, a formal document issued by a seller to a buyer, confirms the details of a product sale by listing items (item, quantity, price) and customer details (name, address), specifying payment terms (credit terms, due date), and outlining expected delivery.

Invoice

An Invoice serves as a record of a sale. It details sold items (item, quantity, price) and customer information (name, address*). It specifies the total amount due (including taxes) and the expected payment terms (due date, credit terms*).

Payment Receive

A payment receipt documents a customer's settlement (name*, amount*, date*). It specifies the payment method (cash, check, etc.) and deposit location. It can also track outstanding invoices for better account management.

Delivery Challan

A Delivery Challan tracks goods movement (not a sale). It documents items (item*, quantity) being delivered (customer*, date*) to a specific location (delivery address*). This ensures clear tracking and verifies goods received.

Credit Note

A credit note, issued by a seller, reduces a buyer's outstanding balance (customer*, date*) due to returns, errors, or price changes. It's not a refund, but a credit applied to the buyer's account for future purchases.

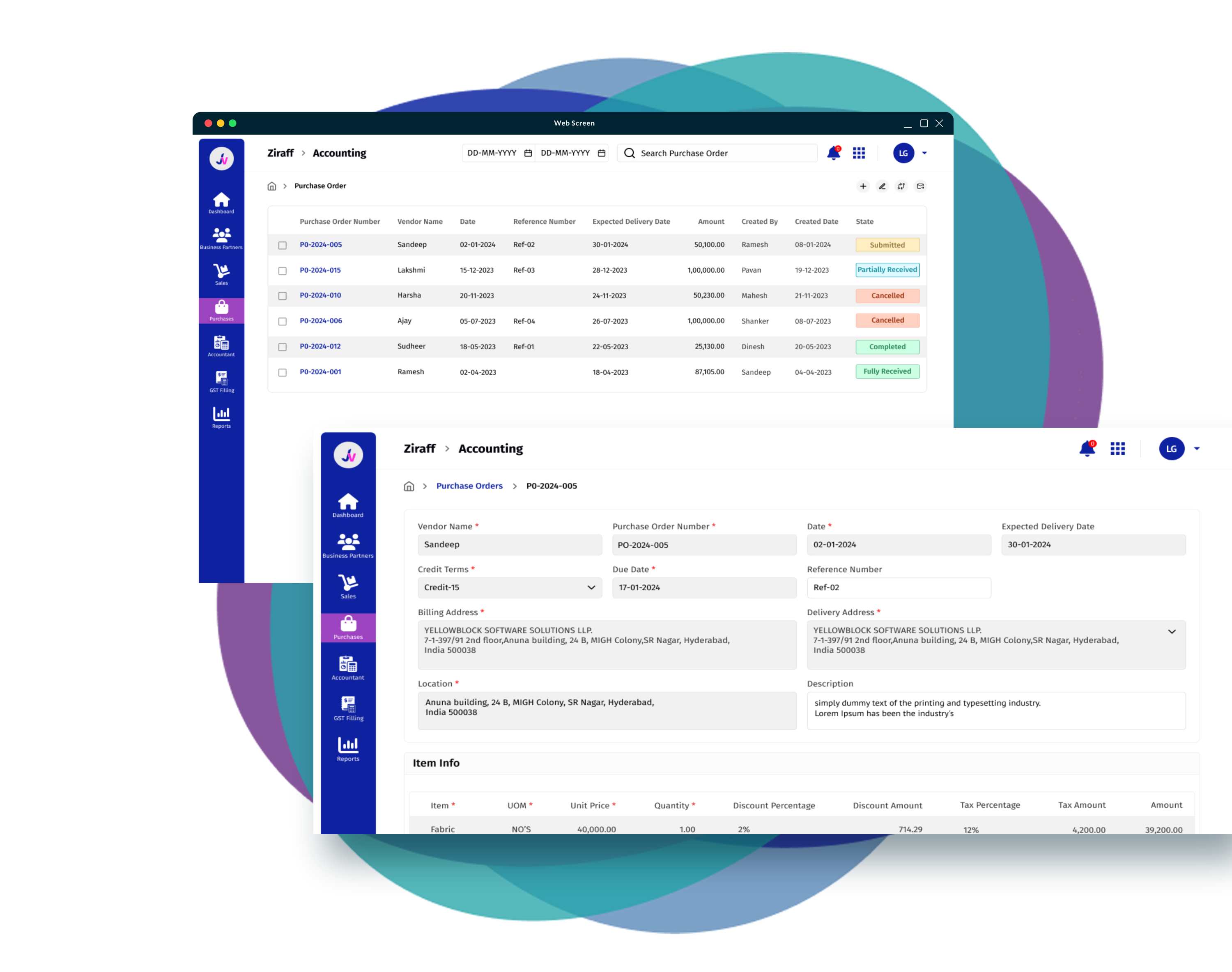

Purchases

Efficiently manage leave balances, requests, approvals, and recommendations through streamlined leave management. Automate holiday calendar updates and integrate leaves into payroll for comprehensive HR administration.

Purchase Order

A purchase order is a buyer's formal request to a supplier. It outlines desired items (optional details) and the expected delivery date. It specifies credit terms (payment delay) and a due date for the delivery address.

Bills

A Bill is a document issued by a seller to a buyer, detailing the goods or services provided, along with the associated costs. It serves as a formal request for payment from the buyer to the seller for the goods or services received.

Purchase Receive

The Purchase Receive feature tracks incoming goods, not saving orders. It verifies received items against purchase orders, ensuring accurate inventory and identifying (received vs. ordered quantities).

Payment Made

The "Payment Made" module or feature within the ERP software allows users to input information about outgoing payments, including details such as the amount paid, the date of payment, the Vendor associated with the payment, and any relevant references or notes.

Debit Note

A purchase return involves sending back goods to a supplier due to defects, incorrect items, or other issues, resulting in an adjustment of the invoice and payment amount.

Expenses

This Feature enables to track the expenses accumulated while operating a business. These expenses encompass the costs accrued during everyday business operations.

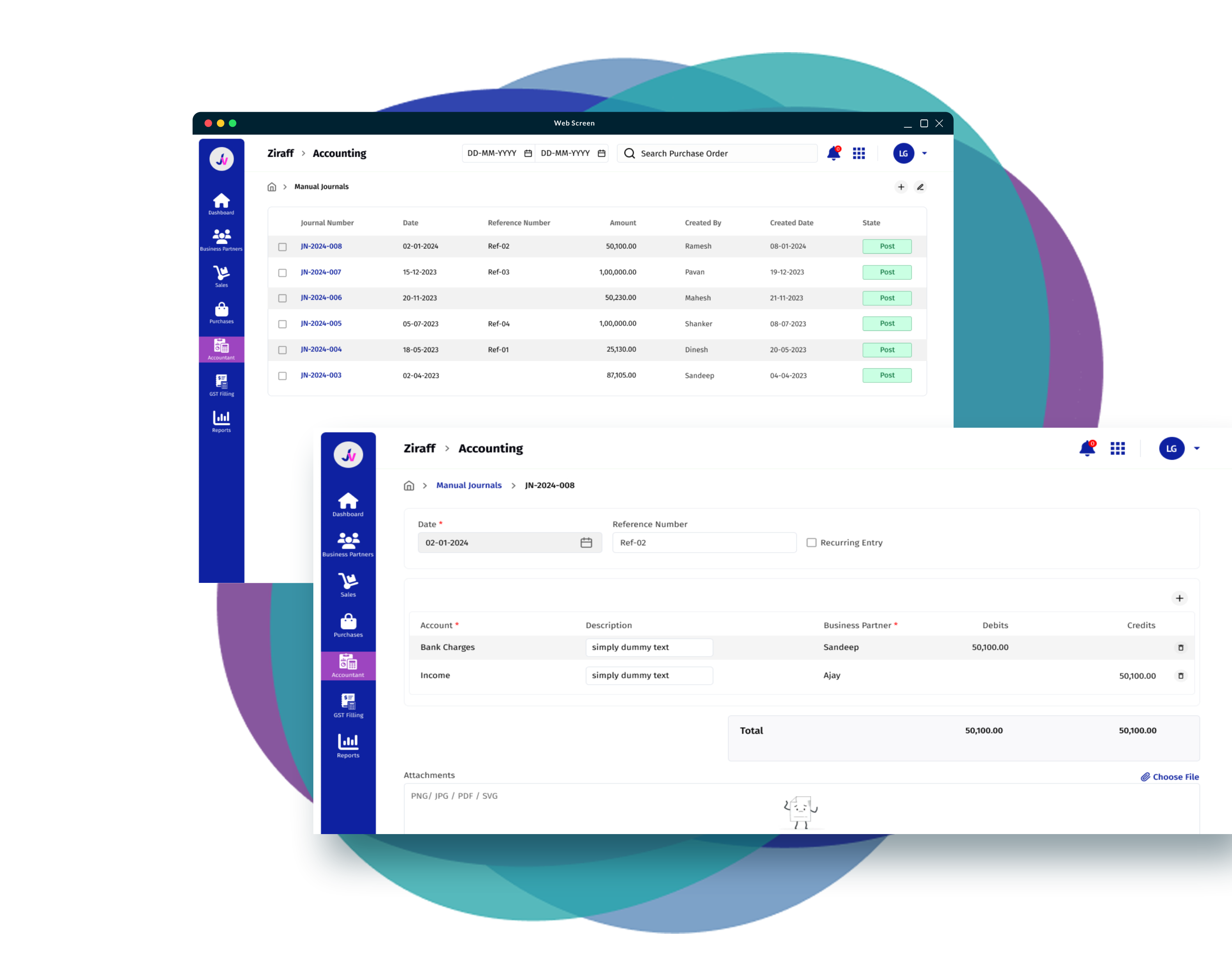

Accounts

Accounts management involves recording financial events through Manual Journals for adjustments and accuracy. The Chart of Accounts categorizes finances for transaction recording, while COA Mapping organizes accounts systematically for tracking. Opening Balances set initial financial states.

Manual Journals

In manual journals (or entries), accountants record financial events outside regular transactions (adjustments, depreciation). Used for error corrections, these entries ensure accurate balances in reports and analyses.

Chart of Accounts

A chart of accounts is a list of financial accounts, grouped into categories, such as assets, liabilities, equity, revenue, and expenses, and used for recording transactions in the organization's general ledger.

COA Mapping

COA Mapping organizes accounts by linking them to specific Types, Categories, and Subcategories within a Chart of Accounts. Think of it as filing accounts in a well-organized system for easier tracking and reporting.

Opening Balance

"Opening Balance" refers to the initial balance or starting balance of an account or financial statement at the beginning of a specified period. It represents the accumulated balance carried forward from the previous accounting period or the initial balance entered when setting up the account.

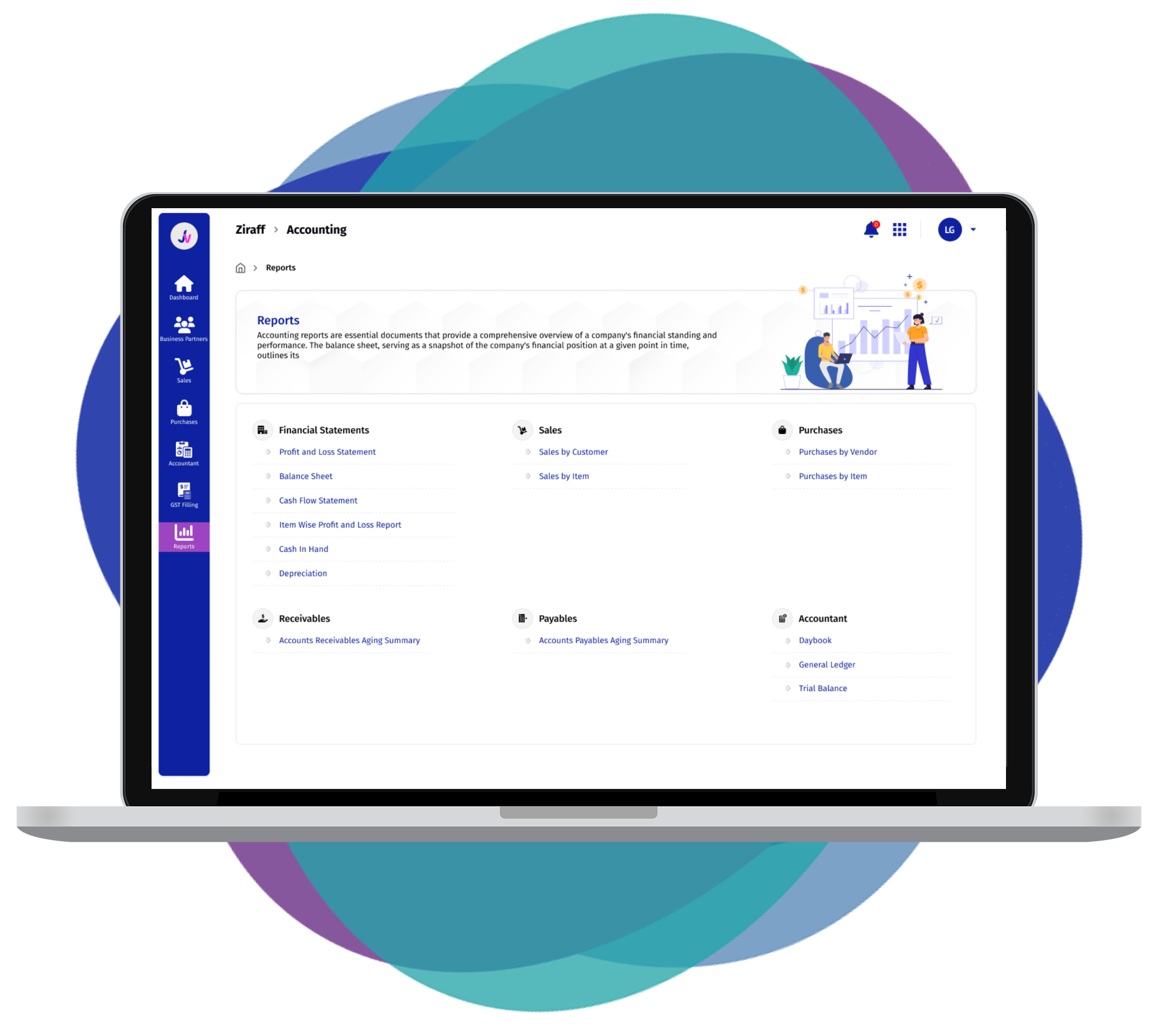

Reports

Generate comprehensive reports summarising transactions for each account, providing insights into financial performance and trends, facilitating decision-making and strategic planning.

Financial Statements

- Horizontal Profit and Loss

- Horizontal Balance Sheet

- Cash Flow Report

Sales

- Sales by Customer

- Sales by Item

Purchases

- Purchases by Vendor

- Purchases by Item

Receivables

- Accounts Receivables Aging Summary

Payables

- Accounts Payables Aging Summary

- Accounts Payables Aging Details

Accountant

- DayBook